1. Introduction

Welcome to the Chirp Developer Guide!

In this document, you will find all the resources you need to learn about, quickly integrate with, and get started using Chirp.

Chirp solutions provide you with features and data you need to build an Instant Financial Verification process and associated workflows for your unique underwriting process. Chirp makes it easy for you to connect to your customers' financial accounts to collect, analyze, and make more informed decisions based on transactional data.

1.1. About Chirp

Chirp is a web-based service with a full set of APIs that provides Instant Financial Verification Data for lenders to mitigate their risk using financial activity of their end customers.

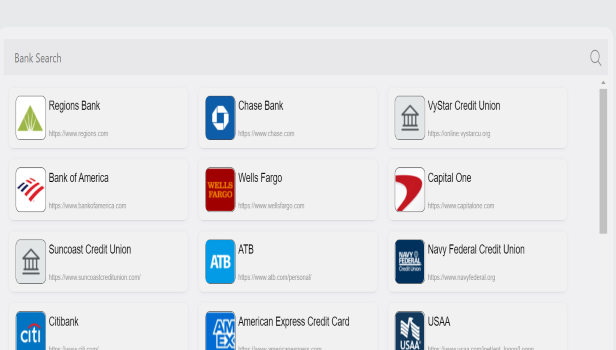

Chirp IFV has real-time access to over 10,000 financial institutions. Chirp enables your business to verify your customers financial information quickly, securely and easily by providing the ability to see real-time financial transactions. Transaction data for a customer is capped at 180 days and 1,500 transactions.

Lenders will be able to create and manage Instant Financial Verification right from their Chirp portal account or from their Loan Management System through Chirp’s API.

2. Working with Chirp APIs

To access the Chirp APIs, you will need an account with Chirp with at least one approved Entity, Profile and User. If you have an active account, you can login to the Chirp Portal to retrieve Sandbox and Production API keys. Please refer here to know more about Chirp’s API tokens.

2.1. Using Chirp Sandbox APIs for Development and Testing

The Chirp Sandbox environment allows you to use the “Sandbox API token” for development and testing. The Sandbox environment limits developers to 5 financial institutions and with a total of 30 users. When production access is enabled all sandbox users are automatically removed by the system.

There are two options to consider when connecting to Sandbox:

- Using the “Chirp Test Bank” financial institution which is preloaded with test users and test data.

- This option allows for testing with sample data and scenarios without creating users and connection to a live bank.

- There are a few supported financial institutions in the Chirp Sandbox environment.

- This option allows for further testing with live financial account data. This option requires a person, with an active online financial institution profile, to participate in the Instant Financial Verification process.

- These financial institutions can be used for testing using real bank credentials in the Sandbox environment.

Note: A request created with a Sandbox token is accessible only in Sandbox environment.

2.1.1. Test credentials for using the “Chirp Test Bank”

This allows for quick testing of different scenarios without creating real financial institution requests. These Test Credentials can only be used when the requests are created in the Sandbox environment using the “Chirp Test Bank”.

| Username | Password | Description |

|---|---|---|

| test_chirp | password | Verification without MFA challenges |

| test_chirp | challenge | Load Multi-Factor Authentication (MFA) challenges. Anwering with the word 'correct' will get through the MFA successfully |

| test_chirp | image | Load image challenge for MFA. Anwering with the word 'correct' will get through the MFA successfully |

| test_chirp | options | Load other available MFA challenges for verification |

| test_chirp | UNAUTHORIZED | For simulating the verification process with invalid credentials |

| test_chirp | SERVER_ERROR | For simulating financial institution with a server error |

If you want to work with one of the 5 financial institutions available in the Sandbox environment, the actual user credentials associated with the selected financial institution account must be used. For instance, if you are selecting USAA Bank, the real credentials for a USAA Bank account must be used.

2.2. Switching to Production

After the requests and responses are successful in Sandbox Environment, you can request to enable Production Access to Chirp API. Chirp by default disables Production access for all Entities. Please contact Chirp to get the production environment enabled for your Entity. You will see the Production token in your Profile details page once Production access is enabled for your Entity. Now all that is needed is just replace the Production token with the Sandbox token and voila! you have successfully switched to Chirp Production environment.

Note: Any information created in Sandbox environment cannot be accessed in Production environment and vice versa.

2.2.1. IP Whitelisting

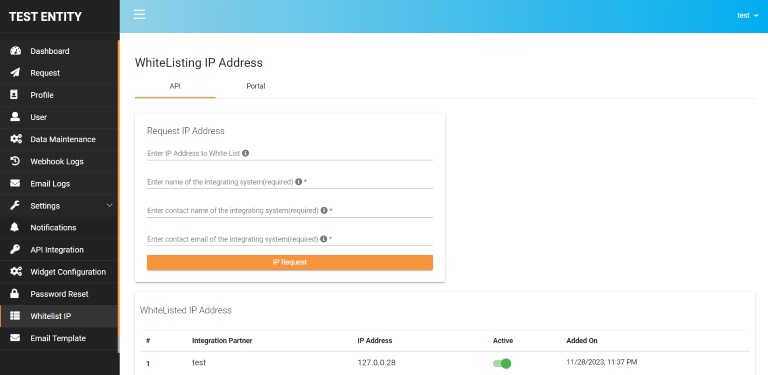

The Production environment is restricted to work only for whitelisted IPs. You can either contact support at [email protected] to whitelist an IP or login to the Portal as the Entity admin and request an ip to whitelist under the WhiteListing menu API. The requested IP will be approved or denied by chirp and you can see the approved whitelisted IP list from the table. Please refer to the screenshot below for further assistance.

Figure 13: Managing IP Whitelisting

2.3. Consuming Chirp API Services

The following sections provide more information about consuming Chirp API services. For additional technical specifications, please check the Chirp API documents in Postman via this link:

https://documenter.getpostman.com/view/24377249/2s8YeuKAisChirp API supports both JSON and XML type responses. To get your desired type of response, simply pass Accept header with “text/xml” for an XML response and “application/json” for a JSON response. By default, the API sends JSON type response if no Accept header is passed along the request.

2.3.1 API Endpoints

2.3.1.1. createRequest

The createRequest endpoint should be used for creating a request for a customer. Once a request is successfully created, a request code is generated for the created request and sent back in the response along with other request specific details.

Note: The createRequest endpoint continues to return both ChirpVerificationURL and LendMateVerificationURL fields for backward compatibility. However, the LendMateVerificationURL field will soon be deprecated. Going forward, it will no longer return any URL containing the lendmate.com domain and will instead return a chirp.digital base URL. Integrators are advised to start using ChirpVerificationURL in place of LendMateVerificationURL.

Payload Field Definition

| # | Field Name | Data Type | Description |

|---|---|---|---|

| 1 | cusFirstName* | String | First name of the customer |

| 2 | cusLastName* | String | Last name of the customer |

| 3 | cusEmail* | String | Customer’s Email |

| 4 | cusAccNumber | String | Customer’s Account Number |

| 5 | cusAbaNumber | String | Customer’s Routing Number |

| 6 | cusAccType | String | Customer’s Account Type |

| 7 | bankName | String | Customer’s bank name |

| 8 | cusPhone* | String | Customer’s Phone Number |

| 9 | customerId | String | The customer id can represent the Unique ID of a customer record used in the system that integrates with Chirp that retains a reference back to Chirp’s requestCode. For example, this can be a customer id or any other unique identifier in the system of record for connecting the Chirp request code with that customer. |

| 10 | notificationEmail | String | Notification Email to receive request status notification updates for the request. This email is used to link to the Customer Level REQUEST_STATUS notification created by Chirp. |

| 11 | lastFourDigitsOfDebitCard | String | A four-digit numeric value representing the last four digits of the user's debit card used for payment or identification purposes on the website. |

| 12 | productId | String | The productId can represent a Unique ID in the system integrated with Chirp that retains a reference back to Chirp’s requestCode. For example, this can be a loan id, application id or any other unique identifier in the system of record for connecting the Chirp requestCode with that product. |

| 13 | leadId | String | Lead Id typically refers to a unique identifier assigned for a lead provider in a system. |

| 14 | leadProvider | String | Lead Provider name associated with a particular lead. |

| 15 | requestXtraHistory | Boolean | Request to retrieve up to 24 months of transaction history. Not all financial institutions will support this request. This is an enhanced endpoint and requires activation by Chirp. Please contact Chirp for more information. Requesting Xtra History will not prevent the createRequest action. All status updates will be sent via the XTRAHISTORY_STATUS notification. |

| 16 | subtype | String | This indicates the subtype of the request (SUBSCRIPTION/PAYG). This field will consider if the product of the entity is in the FLEX plan type. |

| 17 | requestAccountVerification | Boolean | Request to retrieve account and routing numbers for a customer's account. Not all financial institutions will support this request. This is an enhanced endpoint and requires activation by Chirp. Please contact Chirp for more information. |

| 18 | requestAccountOwner | Boolean | Request to retrieve account owner data for a customer's account. Not all financial institutions will support this request. This is an enhanced endpoint and requires activation by Chirp. Please contact Chirp for more information. |

| 19 | notifyIf | Array of Strings |

This field specifies the conditions for sending request status notification updates.

Possible values include: "ALL" – Sends notifications for all status updates. "VERIFIED" – Sends notifications only when the request is verified. "ATTEMPTED" – Sends notifications only when an attempt is made. If "ALL" is specified, notifications will be sent for all status updates; otherwise, they will be sent only for the specified statuses. The notificationEmail and notifyIf fields are mandatory to create an automated Customer Level REQUEST_STATUS notification in Chirp. |

| 20 | customerEnteredEmploymentInfo | Array | Employment Information |

Fields with * appended are mandatory information to pass for creating a request. Any request passed without mandatory information will be restricted from creating the request and appropriate error code and message will be returned in the response. Please check Understanding Error Messages section to know more about error messages and codes returned for various scenarios.

Sample Request Payload

{

"cusFirstName":"John",

"cusLastName":"Doe",

"cusEmail":"[email protected]",

"cusAccNumber":"546561121",

"cusAbaNumber": "322070381",

"cusAccType": "Checking",

"bankName":"chirp_test_bank",

"cusPhone": "+10000000000",

"customerId": "1234",

"notificationEmail": "[email protected]",

"notifyIf" : ["ATTEMPTED", "VERIFIED"],

"lastFourDigitsOfDebitCard" : "1234",

"productId": "4533",

"leadId" : "LEAD-123",

"leadProvider" : "LEAD-ABC",

"requestXtraHistory" : true,

"subtype" : "SUBSCRIPTION",

"requestAccountVerification" : true,

"requestAccountOwner" : true,

"customerEnteredEmploymentInfo": [

{

"employerName": "Walmart",

"monthlyIncome": "500"

},

{

"employerName": "Target",

"monthlyIncome": "650"

},

]

}

Note: The above request payload is just an example. Please do not use the values present in this sample to create a request.

Response Field Definitions

| # | Field Name | Data Type | Description |

|---|---|---|---|

| 1 | RequestCode | String | Code to uniquely identify the request. |

| 2 | CustomerIdentifier | String | The customer id can represent the Unique ID of a customer record used in the system that integrates with Chirp that retains a reference back to Chirp’s requestCode. For example, this can be a customer id or any other unique identifier in the system of record for connecting the Chirp request code with that customer |

| 3 | EmailAddress | String | Customer’s email address |

| 4 | InstitutionUrl | String | Customer’s bank website URL |

| 5 | WidgetURL | String | URL to integrate bank verification widget to lender’s website |

| 6 | ChirpVerificationURL | String | URL for customer to undergo bank verification process. |

| 7 | LendMateVerificationURL | String | URL for customer to undergo bank verification process. Note: This field will be deprecated soon. It will no longer include any lendmate.com references and will return the chirp.digital base URL instead. Please plan to migrate to the ChirpVerificationURL field for continued compatibility. |

| 8 | cusAccNumber | String | Customer’s bank account number |

| 9 | cusAccType | String | Customer’s bank account type |

| 10 | FirstName | String | Customer’ first name |

| 11 | LastName | String | Customer’ last name |

| 12 | AddedOn | Date String | Timestamp of request created. |

| 13 | notificationEmail | String | Notification email address where notification regarding request updates will be sent. |

| 14 | Status | Integer | Status of the request 0 – unverified, 1 – verified, 2 - rejected, 3 – expired |

| 15 | Success | Boolean | Response result of request creation |

| 16 | AddedVia | String | Mode of the request created which is either API/Portal |

| 17 | lastFourDigitsOfDebitCard | String | A four-digit numeric value representing the last four digits of the user's debit card used for payment or identification purposes on the website. |

| 18 | ProductId | String | The productId can represent a Unique ID in the system integrated with Chirp that retains a reference back to Chirp’s requestCode. For example, this can be a loan id, application id or any other unique identifier in the system of record for connecting the Chirp requestCode with that product. |

| 19 | LeadId | String | Lead Id typically refers to a unique identifier assigned for a lead provider in a system. |

| 20 | LeadProvider | String | Lead Provider name associated with a particular lead. |

| 21 | requestXtraHistory | Boolean | Request to retrieve up to 24 months of transaction history. Not all financial institutions will support this request. This is an enhanced endpoint and requires activation by Chirp. Please contact Chirp for more information. |

Understanding error messages for createRequest

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If requested bank is not found | 404 | Bank not found! Please try again with a different bank name |

| 2 | If a request is created using invalid bank name | 400 | Please check the bank name and try again! |

| 3 | If a request is created using invalid email address | 400 | Please check the email address and try again! |

| 4 | If a request is created using invalid account type | 400 | Please check the account type and try again! |

| 5 | If a request is created using invalid first name | 400 | Please check the first name passed and try again! |

| 6 | If a request is created using invalid last name | 400 | Please check the last name passed and try again! |

| 7 | If a request is created using invalid phone number | 400 | Please check the phone number passed and try again! |

| 8 | If a request is created using invalid account number | 400 | Please check the account number passed and try again! |

| 9 | If a request is created using invalid ABA number | 400 | Please check the ABA number passed and try again! |

| 10 | If a request is created using “Chirp Test Bank” with the Production token | 406 | Please use a Sandbox token for testing using “Chirp Test Bank”. |

| 11 | If a request has already been verified with the passed customer details (Customer first name, Customer last name, Customer email, and Customer phone) and does not exceed the configured duplicate prevention period, the request will be considered a duplicate | 400 | Request is already created for the customer and it has also been verified. Please use the portal to create a new request for the customer. |

| 12 | If a request is created using invalid notifyIf field | 400 | notifyIf can only contain 'ALL', 'ATTEMPTED', or 'VERIFIED'. |

2.3.1.2. getRequestDetails

This endpoint returns the below information for all verified requests.

- Accounts linked to the primarily verified account

- Transaction data of the account verified

- Transaction data grouped with transaction type categories

- Transaction count and number of days for each account

- Debit card enrichment information

- The institution name for the account(s) associated

If this endpoint is used for a request which is not successfully verified, the request to get details will be rejected with an error message. Please check the Understanding Error Messages section for more information about handling errors.

The Request details can be retrieved only for Requests that have been authenticated and verified by the customer. For the customer to authenticate and verify their bank account, there needs to be an interface or widget presented to the customer.

Customizing Response

The response transactions of this request can be customized using query parameters in the URL.

Supported Query Parameters

numberOfDays: Specifies the total number of days for which transactions should be retrieved. This parameter filters the transactions based on the specified number of days either in ascending or descending order.

Example URL: https://chirp.digital/api/request/QLU0GU?numberOfDays=30

numberOfTransactions: Determines the total number of transactions to be included in the response.

Example URL: https://chirp.digital/api/request/QLU0GU?numberOfTransactions=50

sort: Specifies the sorting order of the transactions. It can be either ascending or descending.

Example URL: https://chirp.digital/api/request/QLU0GU?sort=ASCENDING

Below is the table explaining the response returned from getRequestDetails,

| # | Field Name | Description |

|---|---|---|

| 1 | Request Code | Request code of the respective request |

| 2 | Success | Response result of the request |

| 3 | Accounts | All the accounts that are linked with the verified bank account |

| 4 | TransactionSummaries | Transaction data of the verified account |

| 5 | TransactionAnalysisSummaries | Transaction data grouped with transaction type categories |

| 6 | AccountExpenses | Expense breakdown based on transaction data |

| 7 | TotalTransactions | Transaction count and number of days for each account |

| 8 | DebitCardEnrichment | Debit card enrichment match details |

| 9 | institutionName | The institution name for the account(s) associated |

| 10 | customerEnteredEmploymentInfo | Employment Information |

Description for fields under Transaction information,

| # | Field | Data Type | Description |

|---|---|---|---|

| 1 | account_guid | String | A unique identifier for the account to which the transaction belongs. |

| 2 | amount | Decimal | The monetary amount of the transaction. Max length is 10,2. |

| 3 | category | String | The category of the transaction. |

| 4 | check_number | Integer | DEPRECATED. Use check_number_string instead. |

| 5 | check_number_string | String | The check number for the transaction. |

| 6 | created_at | String | The date and time the transaction was stored. |

| 7 | currency_code | String | The three-character ISO 4217 currency code, e.g. USD. |

| 8 | date | String | The date the transaction was created. |

| 9 | description | String | A human-readable version of the original_description field described below, e.g., "Sam's Club," "Johnny's Tavern." |

| 10 | guid | String | A unique identifier for the transaction. |

| 11 | is_bill_pay | Boolean | If the transaction is a bill pay, this field will be true. Otherwise, this field will be false. |

| 12 | is_direct_deposit | Boolean | If the transaction is a direct deposit, this field will be true. Otherwise, this field will be false. |

| 13 | is_expense | Boolean | If the transaction is an expense, this field will be true. Otherwise, this field will be false. |

| 14 | is_fee | Boolean | If the transaction is a fee, this field will be true. Otherwise, this field will be false. |

| 15 | is_income | Boolean | If the transaction is income, this field will be true. Otherwise, this field will be false. |

| 16 | is_international | Boolean | If the transaction is international as defined by the data provider, this field will be true. If the data provider determines it is not international, then it will be false. It will be null if the data provider does not have this information. |

| 17 | is_overdraft_fee | Boolean | If the transaction is an overdraft fee, this field will be true. Otherwise, this field will be false. |

| 18 | is_payroll_advance | Boolean | If the transaction is a payroll advance fee, this field will be true. Otherwise, this field will be false. |

| 19 | latitude | Decimal | The latitude of the location where the transaction occurred. The number is a signed decimal. |

| 20 | longitude | Decimal | The longitude of the location where the transaction occurred. The number is a signed decimal. |

| 21 | member_guid | String | A unique identifier for the member to which the transaction belongs. |

| 22 | memo | String | This field contains additional descriptive information about the transaction. |

| 23 | merchant_category_code | Integer | The ISO 18245 category code for the transaction. |

| 24 | merchant_guid | String | The unique identifier for the merchant associated with this transaction. |

| 25 | original_description | String | The original description of the transaction as provided by our data feed. See description above for more information. |

| 26 | posted_at | String | The date and time the transaction was posted. |

| 27 | status | String | The status of the transaction, i.e., POSTED or PENDING. |

| 28 | top_level_category | String | The parent category that this transaction's category is assigned to. |

| 29 | transacted_at | String | The date and time the transaction took place. |

| 30 | type | String | The type of transaction, i.e., CREDIT or DEBIT. |

| 31 | updated_at | String | The date and time the transaction was updated. |

| 32 | user_guid | String | A unique identifier for the user to which this transaction belongs. |

| 33 | is_recurring | Boolean | Recurring payment or transaction |

| 34 | account_id | String | The identifier for the account associated with the transaction |

| 35 | category_guid | String | The identifier for the category of the transaction |

| 36 | id | String | The unique partner-defined identifier for the transaction. This can only be set for partner-managed transactions. It should be ignored for user-managed transactions, even in occasional cases where it may return with a value |

| 37 | is_subscription | Boolean | If transaction represents a payment for a subscription service such as Netflix or Audible |

| 38 | localized_description | String | A human-readable description of the transaction, provided in a local language |

| 39 | localized_memo | String | Additional descriptive information about the transaction, provided in a local language |

| 40 | merchant_location_guid | String | The identifier for the merchant_location associated with this transaction |

| 41 | user_id | String | The unique identifier for the user associated with the transaction |

| 42 | categoryCode | String | The category code of the transaction |

| 43 | parentCategoryCode | String | The parent category code of the transaction |

Description for additional or optional fields under Transaction information,

| # | Field | Data Type | Description |

|---|---|---|---|

| 1 | chirpAccountId | String | The account's unique identifier, as defined by Chirp |

| 2 | chirpTransactionId | String | The transaction's unique identifier, as defined by Chirp |

Description for fields under Account information,

| # | Field | Data Type | Description |

|---|---|---|---|

| 1 | account_number | string | The account number. This will typically be a masked or partial account number. |

| 2 | apr | Decimal | Annual Percentage Rate. Max length is 10,6. |

| 3 | apy | Decimal | Annual Percentage Yield. Max length is 10,6. |

| 4 | available_balance | Decimal | The balance currently available in an account. Max length is 14,2. |

| 5 | available_credit | Decimal | The currently available credit balance of an account. This field is for accounts with types CREDIT CARD and LINE OF CREDIT. |

| 6 | balance | Decimal | An account's current balance. Max length is 14,2. |

| 7 | cash_balance | Decimal | The cash balance of the account. Max length is 14,2. |

| 8 | created_at | String | The date and time the account was created. |

| 9 | credit_limit | Decimal | The credit limit for the account. Max length is 10,2. |

| 10 | currency_code | String | The three-character ISO 4217 currency code, e.g. USD. |

| 11 | guid | String | Unique identifier for the account. |

| 12 | holdings_value | Decimal | The value of the holdings associated with the account. |

| 13 | institution_code | String | Unique identifier for the financial institution which holds the account. |

| 14 | interest_rate | Decimal | Interest rate. Max length is 10,6. |

| 15 | is_closed | Boolean | If an account is closed, this field will be true. Otherwise, this field will be false. |

| 16 | member_guid | String | Unique identifier for the member to which this account belongs. |

| 17 | type | String | The main type of an account, e.g., INVESTMENT, PREPAID, or SAVINGS. |

| 18 | updated_at | String | The date and time at which the account was last updated. |

| 19 | user_guid | String | A unique identifier for the user to which the account belongs. |

| 20 | routing_number | String | The routing number for the account. |

| 21 | insured_name | String | The date and time the account was created |

| 22 | cash_surrender_value | Decimal | Money paid to the policy holder or annuity holder in the event the policy is voluntarily terminated before it matures, or the insured event occurs |

| 23 | day_payment_is_due | String | The day of the month the payment is due. e.g 14 |

| 24 | death_benefit | Integer | The amount paid to the beneficiary of the account upon death of the account owner |

| 25 | last_payment | Decimal | The amount of the recent payment on the account |

| 26 | loan_amount | Decimal | The amount of the loan associated with the account |

| 27 | matures_on | String | The date on which the account matures |

| 28 | minimum_balance | Decimal | The minimum balance of the account |

| 29 | minimum_payment | Decimal | The minimum payment required for an account. This can apply to any debt account |

| 30 | name | String | The human-readable name for the account |

| 31 | original_balance | Decimal | The original balance of the account. This will always be positive |

| 32 | pay_out_amount | String | The amount paid out to the insured person or beneficiary under the conditions of the insurance policy |

| 33 | payoff_balance | Decimal | The payoff balance for a debt account. This will normally be a positive number |

| 34 | premium_amount | Decimal | The insurance policy's premium amount |

| 35 | started_on | String | The date on which a debt account was started |

| 36 | total_account_value | Decimal | The total combining both long and short positions, the sweep account and/or cash balance, and any margin debt linked to a specific account. This figure encompasses the aggregate market value of all positions within the account, offset by any debit balance and the value of short options positions that are profitable. This cumulative value can be negative and should not be misconstrued as an account balance |

| 37 | subtype | String | The account's subtype, e.g., PLAN_401_K, MONEY_MARKET, or HOME_EQUITY |

| 38 | last_payment_at | String | The date and time of the most recent payment on the account |

| 39 | payment_due_at | String | The date and time at which the next payment is due on the account |

| 40 | account_id | String | The unique identifier for the account |

Description for additional or optional fields under Account information,

| # | Field | Data Type | Description |

|---|---|---|---|

| 1 | requestCode | String | Unique code assigned for a customer request |

| 2 | entityId | String | Unique identifier for an entity |

| 3 | profileId | String | Unique identifier for a profile associated with an entity |

| 4 | accountMatch | Boolean | Denotes if the provided account number matches with the account number returned by the financial institution |

| 5 | addedOn | String | The timestamp when the account data for the customer is added in Chirp |

| 6 | modifiedOn | String | The timestamp when the account data for the customer is last modified in Chirp |

| 7 | chirpAccountId | String | The account's unique identifier, as defined by Chirp |

Description for fields under TransactionAnalysisSummaries information,

| # | Field | Data Type | Description |

|---|---|---|---|

| 1 | category | String | A label identifying the type of transaction, for instance, "FEE" |

| 2 | total | Decimal | The total number of transactions within this category |

| 3 | amount | String | The combined total amount for all transactions in this category, for instance, "$32.00" |

| 4 | recentTransactionAmount | String | The amount of the most recent transaction in this category, for instance, "$2.00" |

| 5 | recentTransactionCount | Decimal | The number of recent transactions, for instance, 1 |

| 6 | categoryName | String | The more descriptive name of the category, such as "Fees & Charges" |

| 7 | transaction | Array | Transactions associated with the category |

Understanding error messages for getRequestDetails

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If requesting details for an expired request | 406 | Request status is expired. Please try again with a verified request code |

| 2 | If requesting details for a rejected request | 406 | Request status is rejected. Please try again with a verified request code |

| 3 | If requesting details from a request code that has not been verified | 406 | Request status is unverified. Please verify the request and try again |

2.3.1.3. getRequestStatus

The getRequestStatus endpoint is used to get the current status of a request along with basic request information. Please check the Understanding Error Messages section for more details about handling errors.

Example success response:

Status code: 200

{

"success": true,

"response": {

"RequestCode": "QLU0GU",

"Status": "Attempted",

"FirstName": "John",

"LastName": "Doe",

"Environment": "dev",

"Mode": "Portal",

"VerificationLink": "https://chirp.digital/api/verify?requestCode=QLU0GU",

"SelectedBank": "Chirp Test Bank",

"isAccountConnected": false,

"isLinkExpired": false,

"LastAggregatedAt": "2024-03-12T04:59:15.273Z",

"connectionStatus": "Subscribed",

"statusDetails": "Attempted - Credential Error",

"customerEnteredEmploymentInfo": [

{

"employerName": "Walmart",

"monthlyIncome": "500"

},

{

"employerName": "Target",

"monthlyIncome": "650"

},

]

}

}

Response Field Definitions for getRequestStatus

| # | Field Name | Description |

|---|---|---|

| 1 | RequestCode | Request code passed |

| 2 | Status | Status of the request code passed - “Verified”, “Attempted”, “Rejected”,”Unverified - No Customer Action”, “Unverified - Incomplete Customer Action”, ”Expired” |

| 3 | FirstName | Customer’s first name |

| 4 | LastName | Customer’s last name |

| 5 | Environment | Environment of the request code whether it is dev(Sandbox)/prod(Production) |

| 6 | Mode | Mode of the request created which is either API/Portal |

| 7 | Verification Link | Verification link to be used for customer’s financial verification |

| 8 | Selected Bank | Customer’s Selected bank for verification |

| 9 | isAccountConnected | Denotes if the customer's account is linked and connected |

| 10 | isLinkExpired | Denotes if the verification link can be used any further |

| 11 | LastAggregatedAt | Timestamp when the customer data has been updated. Represented as UTC |

| 12 | connectionStatus | Connection status of the request. This field returns Subscribed/Unsubscribed or Connected/Disconnected or NA as a value based on the plan type |

| 13 | statusDetails | Status details of the request code passed - ”Unverified - No Customer Action”, “Unverified - Incomplete Customer Action”, “Attempted - Bank Error”, “Attempted - In Progress”, “Attempted - Credential Error” |

| 14 | customerEnteredEmploymentInfo | Employment Information |

2.3.1.4. refreshRequest

The refreshRequest endpoint is used to aggregate and pull updated transactions and account data for a request that has already been successfully verified or refreshed.

The refreshRequest is a synchronous operation. Due to the nature of the synchronous operation the user/process that initiates the refresh should wait for a response before moving on to the next step or moving away from the UI.

Attempting to refresh a request within 3 hours of a successful verification or refresh will not be permitted. Chirp will respond with a “405 not allowed” status message. Please check the “Understanding Error Messages” section for more information about error handling.

Sample Request Payload

{

"metaInfo": {

"internalCustomerID": "e4b2f3c0-9c15-4c87-b72a-0f3e6a908fd7",

"internalProductID": "a1d8e2f4-3b87-4c01-8f6d-d5e6a944d2b2",

"refreshID": "b7c1249f-4c89-4379-8704-d9fe5027151e",

"internalCampaignID": "2fa16ec9-390e-4034-87e6-55d3f9cde813"

}

}

Payload definition

| # | Field Name | Data Type | Description |

|---|---|---|---|

| 1 | metaInfo | Object | Optional object that can include up to 5 custom key-value pairs (e.g., contextual metadata related to the request). |

Response Field Definitions for refreshRequest

| # | Tag | Description |

|---|---|---|

| 1 | bankName | Name of the customer’s Institution |

| 2 | aggregatedAt | Last updated timestamp when aggregation was successful |

| 3 | status | Last updated status of the request being refreshed |

| 4 | isBeingAggregated | Denotes if request is still being aggregated in the background |

| 5 | denialReason | Shows denial reason for a failed bank refresh attempt |

Example success response:

Status code: 200

{

"success": true,

"status": "Verified",

"aggregatedAt": "2020-05-29T07:10:43Z",

"isBeingAggregated ": true,

"bankName": "Chirp Test Bank"

}

Understanding error messages for refreshRequest

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If Bank Refresh is not enabled for this profile. | 400 | Bank Refresh is not enabled for this profile. |

| 2 | If the request code is deleted while refreshRequest is attempted | 405 | Your request code is deleted. Please contact administrator. |

| 3 | If the request code is unsubscribed/disconnected while refreshRequest is attempted | 405 | Your request is unsubscribed/disconnected. Please try again with a different request code. Contact Chirp Support for more assistance, [email protected] |

| 4 | If request code is not verified | 405 | Your request code is not verified. Please complete bank verification and try again. |

| 5 | If the request code is expired | 405 | Your request code is expired. Please create a new request and try again. |

| 6 | If refreshRequest is attempted within 3 hrs of a successful verified or refreshed customer. | 405 | A request to refresh was attempted within 3 hours. Please try again later. |

| 7 | If the metaInfo field is invalid | 400 | The field metaInfo must be a valid JSON object. Please check the payload and try again. |

| 8 | If the metaInfo field exceeds its limit | 400 | The field metaInfo only supports up to 5 fields to be passed. Please check the payload and try again. |

| 9 | If the system is unable to process a request from a third-party service or unable to handle requests | 405 | We are unable to process your request. Please contact Chirp support at [email protected] for more details |

2.3.1.5. unsubscribeRequest

The unsubscribeRequest endpoint is used to unsubscribe Subscription based customers and disconnect PAYG (Pay As You Go) based customers from an Entity. Unsubscribing a customer removes the ability to request a refresh of transactions for that customer. However, the last successful set of transactions that were retrieved for an unsubscribed customer will be retained. Please review the Understanding Error Messages section for more details about handling errors.

Note: This action is permanent and cannot be reverted

Example success response:

Status code: 200

{

“success”: “true”,

“message”: "Customer has been unsubscribed or disconnected successfully"

}

Understanding error messages for unsubscribeRequest

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the request code is deleted | 405 | Your request code is deleted. Please contact administrator. |

| 2 | If the request code is unsubscribed/disconnected already | 405 | Invalid action attempted. Request is unsubscribed/disconnected already. |

| 3 | Invalid action | 405 | Invalid Action Attempted. This request code cannot be unsubscribed/disconnected. |

| 4 | If the request code is not eligible to be unsubscribed/disconnected | 405 | Invalid Action Attempted. Request was never in a subscribed/connected state so it cannot be unsubscribed/disconnected |

| 5 | If the system is unable to process a request from a third-party service or unable to handle requests | 405 | We are unable to process your request. Please contact Chirp support at [email protected] for more details |

2.3.1.6. getSummaryInfoByRequestCode

This endpoint returns basic and additional summary information for a verified request. Request code and account number are mandatory fields to pass. Request code can be taken from the response returned by createRequest endpoint. To obtain the accountNumber or chirpAccountId call getRequestAccountDetails. Then use the "account_number" or "chirpAccountId" from the response.

Example success response:

Status code: 200

{

"success": true,

"requestCode": "QLU0GU",

"availableBalance": "$ 1000.00",

"asOfdate": "6/21/2022, 1:42 AM",

"currentBalance": "$ 1000.00",

"customerFirstName": "John",

"customerLastName": "Doe",

"customerEmail": "[email protected]",

"customerAccountInfo": {

"account_number": "1027261114",

"apr": null,

"apy": null,

"available_credit": null,

"cash_balance": null,

"created_at": "2022-06-21T06:42:19Z",

"credit_limit": null,

"currency_code": null,

"holdings_value": null,

"interest_rate": null,

"institution_code": "chirpbank",

"insured_name": null,

"is_closed": false,

"type": "SAVINGS",

"updated_at": "2022-06-21T06:42:19Z",

"routing_number": "12345",

"chirpAccountId": "ACC-2171ee40-1290-11ef-b135-150631c74239",

},

"customerAccountMatchStatus": "No Match",

"customerAccountMatchStatusDescription": "The user entered account number does not match

the account number returned by the financial institution",

"customerRoutingNumberMatchStatus": "No Match",

"customerRoutingNumberMatchStatusDescription": "The user entered routing number does not match

the routing number returned by the financial institution",

"activityByMonth": [

{

"month": "All",

"averageDailyBalance": "$ -461.64",

"averageMonthlyBalance": "$ -461.64",

"totalCredit": "$ 4219.27",

"totalDebit": "$ 1843.64",

"totalpayroll": "$ 0.00",

"totalNet": "$ 2375.63"

},

{

"month": "Mar, 2022",

"averageDailyBalance": "$ -1344.60",

"averageMonthlyBalance": "$ -1344.60",

"totalCredit": "$ 94.22",

"totalDebit": "$ 75.01",

"totalPayroll": "$ 0.00",

"totalNet": "$ 19.21"

},

{

"month": "Apr, 2022",

"averageDailyBalance": "$ -1093.16",

"averageMonthlyBalance": "$ -1093.16",

"totalCredit": "$ 1484.33",

"totalDebit": "$ 800.60",

"totalPayroll": "$ 0.00",

"totalNet": "$ 683.73"

},

{

"month": "May, 2022",

"averageDailyBalance": "$ -385.37",

"averageMonthlyBalance": "$ -385.37",

"totalCredit": "$ 1226.29",

"totalDebit": "$ 633.95",

"totalPayroll": "$ 0.00",

"totalNet": "$ 592.34"

},

{

"month": "Jun, 2022",

"averageDailyBalance": "$ 547.83",

"averageMonthlyBalance": "$ 547.83",

"totalCredit": "$ 1414.43",

"totalDebit": "$ 334.08",

"totalPayroll": "$ 0.00",

"totalNet": "$ 1080.35"

}

],

"totalTransactions": 168,

"numberOfDays": 83,

"customerEnteredAccountNumber": "546561121",

"customerEnteredRoutingNumber": "322070381"

}

Response Field Definitions for getSummaryInfoByRequestCode,

| # | Field Name | Description |

|---|---|---|

| 1 | success | Response result of the request |

| 2 | requestCode | Request code of the respective request |

| 3 | availableBalance | The balance currently available in an account |

| 4 | customerFirstName | First name of the customer |

| 5 | customerLastName | Last name of the customer |

| 6 | customerEmail | Email of the customer |

| 7 | customerAccountInfo | Account info of the connected customer |

| 8 | asOfdate | Request last updated date |

| 9 | currentBalance | An account's current balance |

| 10 | customerAccountMatchStatus | The current match status of the account number entered by the user versus the account number returned by the financial institution |

| 11 | customerAccountMatchStatusDescription | Description of the account number match status value |

| 12 | totalTransactions | Total number of transactions returned |

| 13 | numberOfDays | Total number of days of the transactions returned since inception till date |

| 14 | customerRoutingNumberMatchStatus | The current match status of the routing number entered by the user versus the routing number returned by the financial institution |

| 15 | customerRoutingNumberMatchStatusDescription | Description of the routing number match status value |

| 16 | customerEnteredAccountNumber | Customer’s account number entered into Chirp as part of creating the request. Could have been entered in the Portal or sent via API by the integration partner |

| 17 | customerEnteredRoutingNumber | Customer’s routing number entered into Chirp as part of creating the request. Could have been entered in the Portal or sent via API by the integration partner |

Description for fields under customerAccountInfo,

| # | Field Name | Data Type | Description |

|---|---|---|---|

| 1 | account_number | String | The account number of the customer. This will typically be a masked or partial account number. |

| 2 | apr | Decimal | Annual Percentage Rate |

| 3 | apy | Decimal | Annual Percentage Yield |

| 4 | available_credit | Decimal | The currently available credit balance of an account. |

| 5 | cash_balance | Decimal | The cash balance of the account |

| 6 | created_at | String | The date and time the account was created |

| 7 | credit_limit | Decimal | The credit limit for the account |

| 8 | currency_code | String | The three-character ISO 4217 currency code |

| 9 | holdings_value | Decimal | The value of the holdings associated with the account |

| 10 | interest_rate | Decimal | Interest rate |

| 11 | institution_code | String | Unique identifier for the financial institution which holds the account |

| 12 | insured_name | String | The name of the insured individual |

| 13 | is_closed | Boolean | If an account is closed, this field will be true. Otherwise, this field will be false |

| 14 | type | String | The main type of an account, e.g., INVESTMENT, PREPAID, or SAVINGS |

| 15 | updated_at | String | The date and time at which the account was last updated |

| 16 | routing_number | String | The routing number for the account. |

Description for additional or optional fields under customerAccountInfo,

| # | Field Name | Data Type | Description |

|---|---|---|---|

| 1 | chirpAccountId | String | The account's unique identifier, as defined by Chirp |

Description for fields under activityByMonth,

| # | Field Name | Data Type | Description |

|---|---|---|---|

| 1 | averageDailyBalance | String | Shows month and year for which the activity is calculated. Shows ‘All’ as value for overall time period calculation |

| 2 | month | String | Average daily balance of the customer |

| 3 | averageMonthlyBalance | String | Average monthly balance of the customer |

| 4 | totalCredit | String | Total credit amount returned for the customer |

| 5 | totalDebit | String | Total debit amount returned for the customer |

| 6 | totalpayroll | String | Total payroll amount returned for the customer |

| 7 | totalNet | String | Net amount returned for the customer |

Understanding error messages for getSummaryInfoByRequestCode

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If account number field is empty or invalid | 400 | Account number is mandatory. Please try again with a valid account number. |

| 2 | If requesting details for an expired request | 406 | Request status is expired. Please try again with a verified request code |

| 3 | If requesting details for a rejected request | 406 | Request status is rejected. Please try again with a verified request code |

| 4 | If requesting details from a request code that has not been verified | 406 | Request status is unverified. Please verify the request and try again |

| 5 | If the account number passed is invalid | 400 | Account number passed is invalid. Please try again with a valid account number. |

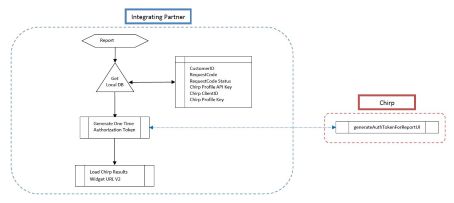

2.3.1.7. generateAuthTokenForReportUI

The generateAuthTokenForReportUI endpoint should be used for generating a one-time usable token for rendering verification reports hosted as an Iframe in a webpage. The token generated is only valid for a single use and any subsequent usage of the same token will result in Authorization errors. This endpoint requires one of the following combinations to be passed in the username and password fields for generating a valid token:

1. Entity username in the username field and Entity password in the password field along with the verification Request Code

2. Entity Client Id in the username field and Profile API Access Token in the password field along with the verification Request Code.

Request Field Definitions

| # | Field Name | Description |

|---|---|---|

| 1 | username* | <Entity user's username> or <Entity Client ID> |

| 2 | password* | <Entity user's password> or <Entity Profile Token> |

| 3 | requestCode* | Verified request code |

Fields appending with an asterisk (*) are required for creating a request. Any request missing required fields will be denied, and the corresponding error code with message will be returned in response. Please check the “Understanding Error Messages” section for more information about error handling.

Sample Request Payload

{

"username":"<Entity user's username> or <Entity Client ID>",

"password":"<Entity user's password> or <Entity Profile Token>",

"requestCode":"<request code>",

}

Request Field Definitions

| # | Field Name | Description |

|---|---|---|

| 1 | token | One-time usable token generated for rendering a customer report via the hosted render report UI V2 |

| 2 | validUpto | The expiration time until the generated token is valid. Timezone is CST |

| 3 | validForRequestCode | The request code for which the token is valid |

Status code: 200

{

"success": true,

"result":

{

"token":"eyJhbGciOiJSUzUxMiIsInR5cCI6IkpXVCJ9.eyJlbnRpdHlJZCI6IjVmZjFl

MWQwZDQyMzRiMDJkYTc2ZWJmYiIsInVzZXJJZCI6IjVmZjFlMWQwZDQyMzRiM

DJkYTc2ZWJmYSIsInJlcXVlc3RDb2RlIjoiTENVWEk2IiwicHJvZmlsZUlkIj

oiNWZmMWUxZDBkNDIzNGIwMmRhNzZlYmZjIiwiaWF0IjoxNjI3OTAyMTA5LC

JleHAiOjE2Mjc5MjAxMDl9.Aq_VU0lgNl1v-qI690xRqaxUuEViARdV1JCq9K

7v19v2H0wd3V8O4JQLwBkOl-mhqNaO6P9qnnSPREvrANp4nAZhVB3OVfgQKX18

eEVVAaIeLf8Cr7GG2ml1jJgasN48ouK9Hs5utVJEGvfKpRT3Qa_EZaw139WzSL

GPgDPI120",

"validUpto": "8/2/2022, 11:01 AM",

"validForRequestCode": "QLU0GU"

}

}

Understanding error messages for generateAuthTokenForReportUI

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the request code field is empty | 400 | Request code is missing. Please try again with a valid request code. |

| 2 | If the request code is invalid | 400 | Request code <requestCode> is invalid. Please contact the company you are working with for further assistance. |

| 3 | If request code passed is not verified | 400 | Request must be verified before a token can be generated. Please try again with a verified request. |

| 4 | If the Request code is not associated with the entity. | 400 | Request code is not associated with the entity. |

| 5 | If user authorization failed due to invalid creds | 401 | User authorization failed due to invalid credentials. Please try again with valid credentials. |

2.3.1.8. getRequestReportAsPDF

The getRequestReportAsPDF endpoint is used to generate a PDF report for a successfully verified request. The endpoint should only be called after a successful verified request has been completed. If webhooks are not being used the status of a request can be found using the getRequestStatus endpoint.

After calling getRequestReportAsPDF with a successfully completed verification a link to download the generated PDF report is generated and returned in the response. The link can be used to download the generated PDF report. The link and the generated PDF report are valid for 12 hours after being generated. After 12 hours the link and PDF report will be removed from the system.

The request code and account number or chirp account id are mandatory fields to pass. Request code can be taken from the response returned by createRequest endpoint and Account number or Chirp Account Id can be taken from getRequestDetails response.

Example getRequestReportAsPDF Request:

{

"requestCode": "QLU0GU",

"accountNumber": "XXXXXX" or "chirpAccountId": "ACC-89714aa1-71e8-11f0-8ae6-4b6cb8f9aefd"

}

Example Successful Response:

{

"success": true,

"requestCode": "QLU0GU",

"fileDownloadLink": "https://chirp.digital/public/XXXXXX_2022-06-01T02-12"

}

Response Field Definitions for getRequestReportAsPDF,

| # | Field Name | Description |

|---|---|---|

| 1 | success | Response result of the request |

| 2 | requestCode | Request code of the respective request |

| 3 | fileDownloadLink | The Link to download the generated PDF report |

Understanding error messages for getRequestReportAsPDF

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the request code field is empty | 400 | Request code is missing. Please try again with a valid request code. |

| 2 | If Account Number or Chirp Account Id field is empty or invalid | 400 | Account number or Chirp Account Id field is mandatory. Please try again with a valid Account Number or Chirp Account Id. |

| 3 | If the access is forbidden | 400 | Access forbidden. Please check the environment of the API token passed and try again! |

| 4 | If requesting details for an expired request | 406 | Request status is expired. Please try again with a verified request code |

| 5 | If requesting details for a rejected request | 406 | Request status is rejected. Please try again with a verified request code |

| 6 | If requesting details from a request code that has not been verified | 406 | Request status is unverified. Please verify the request and try again |

2.3.1.9. updateRequestStatus

The updateRequestStatus endpoint is used to update the status of a request. The endpoint currently only supports updating the status of a request from Attempted to Rejected.

Sample Request Payload

{

"requestCode":"QLU0GU",

"statusToUpdate":"REJECTED",

}

Example success response:

Status code: 200

{

"success": true,

"message": "The request has been updated to Rejected status successfully"

}

Understanding error messages for updateRequestStatus

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If status to update is invalid | 400 | Please check the status to update and try again! |

| 2 | If the request code is already rejected | 400 | Request code <requestCode> cannot set to Rejected beacuse the status is already Rejected |

| 3 | Request code needs to be attempted before reject | 400 | Current status of the request is <status> and cannot be set to rejected. |

| 4 | If entered customer not found | 404 | Customer not found. |

2.3.1.10. getRequestTrackInfo

The getRequestTrackInfo endpoint takes upto 1000 request codes per request and returns all relevant track level information. This information can be used to sync the data in the LMS system. The response returns information for only valid and applicable request codes passed while invalid request codes and requests that do not belong to the profile associated with the authorization token are ignored.

Sample Request Payload

{

"requestCodes" : "[\"QLU0GU\",\"YYYYYY\",\"ZZZZZZ\"]"

}

Example success response:

Status code: 200

{

"success": true,

"result": [

{

"requestCode": "QLU0GU",

"customerName": "John Deo",

"email": "[email protected]",

"phone": "1111111111",

"entityName": "Test Entity",

"profileName": "Test Profile",

"accessInfo": "Portal",

"bankName": "Chirp Test Bank",

"status": "Verified",

"planType": "FLEX",

"subtype" : "SUBSCRIPTION",

"subscriptionStatus": "NA",

"addedOn": "2022-08-08T12:10:49.826Z",

"attemptedOn": "2022-08-08T12:11:16.998Z",

"verifiedOn": "2022-08-08T12:22:16.998Z",

"rejectedOn": "NA",

"unsubscribedOn": "2022-08-08T12:11:36.507Z",

"statusDetails": "NA",

"customerEnteredEmploymentInfo": [

{

"employerName": "Walmart",

"monthlyIncome": "500"

},

{

"employerName": "Target",

"monthlyIncome": "650"

},

]

}

]

}

Note:

1. The requestCodes field in the payload should be stringified.

Response Field Definitions for getRequestTrackInfo,

| # | Field Name | Description |

|---|---|---|

| 1 | requestCode | Code to uniquely identify the request |

| 2 | customerName | Customer’s first and last name |

| 3 | Customer’s email | |

| 4 | phone | Customer’s phone |

| 5 | entityName | Entity business name to which the customer is associated |

| 6 | profileName | Profile name to which the customer is associated |

| 7 | accessInfo | Access of the request created, either API/Portal |

| 8 | bankName | Customer’s selected bank |

| 9 | status | Status of the request code - “Unverified”, “verified”, “Attempted”, “Rejected”, “Expired” |

| 10 | planType | Plan type of the request code - SUBSCRIPTION/PAYG/FLEX |

| 11 | subscriptionStatus | Subscription of the request code - Subscribed/Unsubscribed |

| 12 | addedOn | Timestamp when request is added |

| 13 | attemptedOn | Timestamp when request is attempted |

| 14 | verifiedOn | Timestamp when request is verified |

| 15 | rejectedOn | Timestamp when request is rejected |

| 16 | unsubscribedOn | Timestamp when request is unsubscribed |

| 17 | subtype | Subtype of the request code - SUBSCRIPTION/PAYG. This field will be returned if the planType is "FLEX" |

| 18 | statusDetails | Status details of the request code passed - ”Unverified - No Customer Action”, “Unverified - Incomplete Customer Action”, “Attempted - Bank Error”, “Attempted - In Progress”, “Attempted - Credential Error” |

| 19 | customerEnteredEmploymentInfo | Employment Information |

Understanding error messages for getRequestTrackInfo

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the request code field is empty | 400 | The requestCodes field is mandatory. Please try again with a valid payload in the request body |

| 2 | If the parsed stringified data is not an array of strings or invalid | 400 | The requestCodes field is in invalid format. Please try again with a valid payload in the request body |

| 3 | If the payload contains more than 1000 request codes | 400 | Maximum allowed request code limit is 1000. Please try again with a valid payload in the request body |

2.3.1.11. createCustomerNotification

The createCustomerNotification endpoint is used to create a customer level configuration for triggering Chirp notifications. If an entity has its own notification configuration added then the notification configuration added for the customer level will override the entity level notification configuration.

Payload Field Definition for createCustomerNotification,

| # | Field | Data Type | Description |

|---|---|---|---|

| 1 | name* | String | Name for the customer notification |

| 2 | requestCode* | String | Code to uniquely identify the request. |

| 3 | type* | String | Type of notification |

| 4 | rule* | String | Rule of the notification type |

| 5 | amount | Number | Amount to filter customer’s financial informations |

| 6 | webhookUrl | Array of strings | Webhook url to send chirp notifications(Maximum of 2 URLs can be configured for REQUEST and REFRESH type) |

| 7 | emails | Array of strings | Emails to send chirp notifications |

| 8 | notifyViaEmail* | Boolean | Boolean value to active email notifications |

| 9 | notifyViaWebhook* | Boolean | Boolean value to active webhook notifications |

| 10 | active* | Boolean | Boolean value to make the notification active |

| 11 | keywords | Array of strings | Keywords to match the description of a transaction |

| 12 | enableRetryTimeout | Boolean | Boolean value to activate retrying timeout webhooks |

| 13 | retryTimeout | Number | Automatically retry posting the webhook notification if the initial attempt results in a timeout. This number field denotes the interval for retrying in hours. |

| 14 | authorizationType | String | Type of authorization used. Values: NONE, BASIC, OAUTH2, JWT, KEY_VALUE. (Note : If authorization is not needed, pass "NONE" or omit the authorizationType field.) |

| 15 | authorizationToken | String | Specifies the authorization token. Required if authorizationType is BASIC, OAUTH2, or JWT. |

| 16 | authorizationHeaderKey | String | Required if authorizationType is KEY_VALUE. Custom header key (e.g., x-api-key). |

| 17 | authorizationHeaderValue | String | Required if authorizationType is KEY_VALUE. Value for the custom header. |

| 18 | retryLimit | Number | Maximum number of times the system will attempt to resend a webhook notification if previous attempts fail. (Max - 5) |

| 19 | retryEmail | String | Email address to which an error alert is sent if the final retry attempt fails |

Fields with * appended are mandatory information to pass for creating a customer notification. Any request passed without mandatory information will be restricted from creating the customer notification and appropriate error code and message will be returned in the response. Please check Understanding Error Messages section to know more about error messages and codes returned for various scenarios.

Sample Request Payload

{

"name":"YYYYYYYY",

"requestCode" : "QLU0GU",

"type":"DEPOSIT",

"rule" : "GREATER_THAN",

"amount" : 44,

"emails" : ["[email protected]"],

"notifyViaEmail" : true,

"notifyViaWebhook" : true,

"webhookUrl" : ["https://example.com"],

"active" : true,

"enableRetryTimeout" : true,

"retryTimeout" : 2,

"authorizationType" : "BASIC",

"authorizationToken" : "ey502880824ff933a4014ff9345d7c0001",

"retryLimit" : 4,

"retryEmail" : "[email protected]"

}

Example success response:

Status code: 200

{

"success": true,

"message": "Customer notification configuration added successfully!"

}

Understanding error messages for createCustomerNotification

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the request code passed has already customer configuration with passed type | 409 | This customer already has a notification configuration with the type |

| 2 | If the notification channel is not provided | 400 | Please provide a notification channel and try again! |

| 3 | If passed type and rule are inappropriate | 400 | Please check the type and rule and try again! |

| 4 | If entered keywords are invalid | 400 | Please check the keywords and try again later. |

| 5 | If invalid webhook url is passed | 400 | Please check the webhookUrl and try again |

| 6 | If one or more invalid emails are passed | 400 | Please check the emails and try again |

| 7 | If notifyViaWebhook field are invalid | 400 | Please enable the notifyViaWebhook field and try again |

| 8 | If notifyViaEmail field are invalid | 400 | Please enable the notifyViaEmail field and try again |

| 9 | If invalid retryTimeout field is passed | 400 | Please check the retryTimeout and try again |

| 10 | If enableRetryTimeout field is invalid | 400 | Please enable the enableRetryTimeout field and try again |

| 11 | If the request code is other than subscription or flex-subscription plan type | 400 | Your current plan does not support this type of notification configuration. Please contact [email protected] for more info |

| 12 | If passed authorizationType is invalid | 400 | Please check the authorization type and try again! |

| 13 | If passed authorizationToken is invalid | 400 | Please check the authorization token and try again! |

| 14 | If passed authorizationHeaderKey or authorizationHeaderValue is invalid | 400 | Both authorizationHeaderKey and authorizationHeaderValue are required for KEY_VALUE authorization. |

| 15 | If invalid retryLimit field is passed | 400 | Please check the retryLimit type and try again! |

| 16 | If invalid retryEmail field is passed | 400 | Please check the retryEmail token and try again! |

| 17 | If the request code is unsubscribed/disconnected. | 405 | Your request is unsubscribed/disconnected. Please try again with a different request code. Contact Chirp Support for more assistance, [email protected] |

2.3.1.12. updateCustomerNotification

The updateCustomerNotification endpoint is used to update an existing customer-level notification in Chirp

Note: If emails are required to be updated then a prior update to the field notifyViaEmail is required to set as true. If the value of notifyViaEmail is already true then no prior update is required for updating the emails fields. This applies to the field webhook also where notifyViaWebhook is the field to update as true.

Payload Field Definition for updateCustomerNotification,

| # | Field | Data Type | Description |

|---|---|---|---|

| 1 | name | String | Name for the customer notification |

| 2 | type | String | Type of notification |

| 3 | rule | String | Rule of the notification type |

| 4 | amount | Number | Amount to filter customer’s financial informations |

| 5 | webhookUrl | Array of string | Webhook url to send chirp notifications |

| 6 | emails | Array of strings | Emails to send chirp notifications |

| 7 | notifyViaEmail | Boolean | Boolean value to active email notifications |

| 8 | notifyViaWebhook | Boolean | Boolean value to active webhook notifications |

| 9 | active | Boolean | Boolean value to make the notification active |

| 10 | keywords | Array of strings | Keywords to match the description of a transaction |

| 11 | enableRetryTimeout | Boolean | Boolean value to activate retrying timeout webhooks |

| 12 | retryTimeout | Number | Automatically retry posting the webhook notification if the initial attempt results in a timeout. This number field denotes the interval for retrying in hours. |

| 13 | authorizationType | String | Type of authorization used. Values: NONE, BASIC, OAUTH2, JWT, KEY_VALUE. (Note : If authorization is not needed, pass "NONE" or omit the authorizationType field.) |

| 14 | authorizationToken | String | Specifies the authorization token. Required if authorizationType is BASIC, OAUTH2, or JWT. |

| 15 | authorizationHeaderKey | String | Required if authorizationType is KEY_VALUE. Custom header key (e.g., x-api-key). |

| 16 | authorizationHeaderValue | String | Required if authorizationType is KEY_VALUE. Value for the custom header. |

| 17 | retryLimit | Number | Maximum number of times the system will attempt to resend a webhook notification if previous attempts fail. (Max - 5) |

| 18 | retryEmail | String | Email address to which an error alert is sent if the final retry attempt fails |

Sample Request Payload

{

"name":"YYYYYYYY",

"type":"DEPOSIT",

"rule" : "GREATER_THAN",

"amount" : 44,

"emails" : ["[email protected]"],

"notifyViaEmail" : true,

"notifyViaWebhook" : true,

"webhookUrl" : ["https://example.com"],

"active" : true,

"enableRetryTimeout" : true,

"retryTimeout" : 2,

"authorizationType" : "BASIC",

"authorizationToken" : "ey502880824ff933a4014ff9345d7c0001",

"retryLimit" : 4,

"retryEmail" : "[email protected]"

}

Example success response:

Status code: 200

{

"success": true,

"message": "Customer notification configuration updated successfully!"

}

Response Field Definitions for updateCustomerNotification,

| # | Field Name | Description |

|---|---|---|

| 1 | success | Response result of the request |

| 2 | message | Success message |

Understanding error messages for updateCustomerNotification

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the request code passed has already customer configuration with passed type | 409 | This customer already has a notification configuration with the type |

| 2 | If passed type and rule are inappropriate | 400 | Please check the type and rule and try again! |

| 3 | If entered keywords are invalid | 400 | Please check the keywords and try again later. |

| 4 | If invalid webhook url is passed | 400 | Please check the webhookUrl field and try again |

| 5 | If one or more invalid emails are passed | 400 | Please check the emails and try again |

| 6 | If notifyViaWebhook field is invalid | 400 | Please enable the notifyViaWebhook and try again |

| 7 | If notifyViaEmail field is invalid | 400 | Please enable the notifyViaEmail field and try again |

| 8 | If webhook url passed is more than 2 for REQUEST and REFRESH type | 400 | A maximum of only 2 URLs can be configured |

| 9 | If invalid retryTimeout field is passed | 400 | Please check the retryTimeout and try again |

| 10 | If enableRetryTimeout field is invalid | 400 | Please enable the enableRetryTimeout field and try again |

| 11 | If passed authorizationType is invalid | 400 | Please check the authorization type and try again! |

| 12 | If passed authorizationToken is invalid | 400 | Please check the authorization token and try again! |

| 13 | If passed authorizationHeaderKey or authorizationHeaderValue is invalid | 400 | Both authorizationHeaderKey and authorizationHeaderValue are required for KEY_VALUE authorization. |

| 14 | If invalid retryLimit field is passed | 400 | Please check the retryLimit type and try again! |

| 15 | If invalid retryEmail field is passed | 400 | Please check the retryEmail token and try again! |

2.3.1.13. getCustomerNotification

The getCustomerNotification endpoint is used to get all customer-level notifications Chirp notifications. Please check the Understanding Error Messages section for more details about handling errors.

Note: If the query param type is passed with an appropriate value then the response is filtered with it. If the request has no type value added as indicated above then all the notifications configured for the customer are returned.

Example Successful Response:

{

"success": true,

"result": [

{

"emails": [

"[email protected]"

],

"addedOn": "2023-01-04T08:01:09.515Z",

"modifiedOn": "2023-01-04T08:01:09.515Z",

"requestCode": "QLU0GU",

"name": "YYYYYY",

"cusFirstName": "John",

"cusLastName": "Deo",

"type": "ACC_CONNECTION_STATUS",

"rule": "REMOVED",

"webhookUrl": "www.example.com",

"active": true,

"notifyViaEmail": true,

"notifyViaWebhook": true,

"amount": 0,

"enableRetryTimeout" : true,

"retryTimeout" : 2,

"authorizationType" : "BASIC",

"authorizationToken" : "ey502880824ff933a4014ff9345d7c0001",

"retryLimit" : 4,

"retryEmail" : "[email protected]"

}

]

}

Response Field Definitions for getCustomerNotification,

| # | Field Name | Description |

|---|---|---|

| 1 | success | Response result of the request |

| 2 | result | Notification configurations associated with the requestCode |

Understanding error messages for getCustomerNotification

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the customer has no notification added | 404 | This customer has no notification configuration added! |

2.3.1.14. removeCustomerNotification

The removeCustomerNotification endpoint is used to remove the customer-level notification from Chirp.

Example Successful Response:

{

"success": true,

"message": "Customer notification configuration removed successfully!"

}

Response Field Definitions for removeCustomerNotification,

| # | Field Name | Description |

|---|---|---|

| 1 | success | Response result of the request |

| 2 | message | Success message |

Understanding error messages for removeCustomerNotification

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the customer has no notification added | 404 | This customer has no notification configuration with the type |

2.3.1.15. isRoutingNumberAvailable

This endpoint is used to find if the passed routing number associated with the financial institution is supported by Chirp or not. A simple boolean response is returned to denote the support. This endpoint is secured the same as other endpoints and requires the API token that can be found in the profile details page for authorization. More technical details and sample response information about this and other endpoints can be found on the Postman documentation.

Sandbox token only supports a dummy value such as 000000000 to be passed to help with the integration

Example Successful Response:

true

Understanding error messages for isRoutingNumberAvailable

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If routing number is empty or invalid | 400 | Routing number is mandatory |

2.3.1.16. updateCustomerId

The updateCustomerId endpoint is used to update the customer id of a request. The customer id can represent the Unique ID of a customer record used in the system that integrates with Chirp that retains a reference back to Chirp’s requestCode. For example, this can be a customer id or any other unique identifier in the system of record for connecting the Chirp request code with that customer.

Sample Request Payload

{

"customerId": “XXXXXXXXXX”

}

Example success response:

Status code: 200

{

"success": true,

"message": "Customer Id updated successfully",

}

Understanding error messages for updateCustomerId

| # | Scenario | Error Code | Error Message |

|---|---|---|---|

| 1 | If the customerId field in the body is missing | 400 | Customer Id is mandatory. Please try again with a valid customer id. |

2.3.1.17. debitCardEnrichment

The endpoint is used to get the debit card enrichment of a customer by filtering transactions with debit card enrichment. Debit Card Enrichment will be performed using the last 4 digits of the debit card provided via the API as well as reporting back the last 4 digits of any additional debit cards that are found.

The transactions associated with the debit card can also be retrieved along with the response by passing the “transaction” query parameter with the value set to true in the request. If omitted from the request the transaction query parameter default value is false.

The debit card enrichment details can also be obtained for each account. To get the account details pass the “byAccount” query parameter with the value set to true in the request. If omitted from the request the “byAccount” query parameter default value is false.

Here is an example url with the query parameter “transactions” added for retrieving transactions - https://chirp.digital/api/debitCardEnrichment/QLU0GU?debitCardNumber=1234&transaction=true

Here is an example url with the query parameters “transaction” and “byAccount” added for retrieving details by account - https://chirp.digital/api/debitCardEnrichment/QLU0GU?debitCardNumber=1234&transaction=true&byAccount=true

Example success response:

Status code: 200

{

"success": true,

"requestCode": "QLU0GU",

"result": [

{

"lastFourDebitCardNumber": "1234",

"debitCardIndicatorMessage": "2 out of 1000 transaction matches",

"cardMatches": true,

"debitCardIndicatorStatus": "Low",

"autoFlaggedDebit" : false,

"transactions": [

{

"category": "Utilities",

"created_at": "2023-07-12T10:47:10Z",

"date": "2023-07-11",

"posted_at": "2023-07-12T12:00:00Z",

"status": "POSTED",

"top_level_category": "Bills & Utilities",

"transacted_at": "2023-07-11T12:00:00Z",

"type": "DEBIT",

"updated_at": "2023-07-12T10:47:10Z",

"account_guid": "ACT-114eddee-27c7-4661-96bb-c3d5343419ed",

"account_id": "act-223434333",

"amount": 58.92,

"category_guid": "CAT-56a2979d-d6df-25da-f357-06282f08208e",

"check_number_string": null,

"currency_code": "USD",

"description": "Questar Gas",

"guid": "TRN-e9d83fa5-549e-43d1-afbc-c6651c47c96a",

"id": "transfer-6a374f0f-488c-4258-82da-7c2c4ec5fe3f",

"is_bill_pay": false,

"is_direct_deposit": false,

"is_expense": true,

"is_fee": false,

"is_income": false,

"is_international": null,

"is_overdraft_fee": false,

"is_payroll_advance": false,

"is_recurring": null,

"is_subscription": false,

"latitude": null,

"localized_description": null,

"localized_memo": null,

"longitude": null,

"member_guid": "MBR-9ad03e4a-1e1b-420e-984a-7da2c8c8fb7c",

"member_is_managed_by_user": true,

"memo": null,

"merchant_category_code": null,

"merchant_guid": null,

"merchant_location_guid": null,

"original_description": "card 1234",

"user_guid": "USR-6b718e0b-b1f1-4819-96c3-dd2a340a9585",

"user_id": "6d896b50-20a1-11ee-a149-6fd473c3e4b4",

"categoryCode": "UTL",

"parentCategoryCode": "BNU",

"debitCardNumber": "1234"

},

{

"category": "Transfer",

"created_at": "2023-07-12T10:47:19Z",

"date": "2023-07-11",

"posted_at": "2023-07-12T12:00:00Z",

"status": "POSTED",

"top_level_category": "Transfer",

"transacted_at": "2023-07-11T12:00:00Z",

"type": "DEBIT",

"updated_at": "2023-07-12T10:47:19Z",

"account_guid": "ACT-164a6ebb-be76-415e-8adc-c27853ef2eb8",

"account_id": "act-6744344",

"amount": 13.03,

"category_guid": "CAT-bce48142-fea4-ff45-20d9-0a642d44de83",

"check_number_string": null,

"currency_code": "USD",

"description": "Transfer From Savings",

"guid": "TRN-4ba4626c-607a-4761-8e9a-24e6906085a7",

"id": "transfer-7c187810-8704-4288-91f3-d7b4f2f96d5c",

"is_bill_pay": false,

"is_direct_deposit": false,

"is_expense": true,

"is_fee": false,

"is_income": false,

"is_international": null,

"is_overdraft_fee": false,

"is_payroll_advance": false,

"is_recurring": null,

"is_subscription": false,

"latitude": null,

"localized_description": null,

"localized_memo": null,

"longitude": null,

"member_guid": "MBR-9ad03e4a-1e1b-420e-984a-7da2c8c8fb7c",

"member_is_managed_by_user": true,

"memo": null,

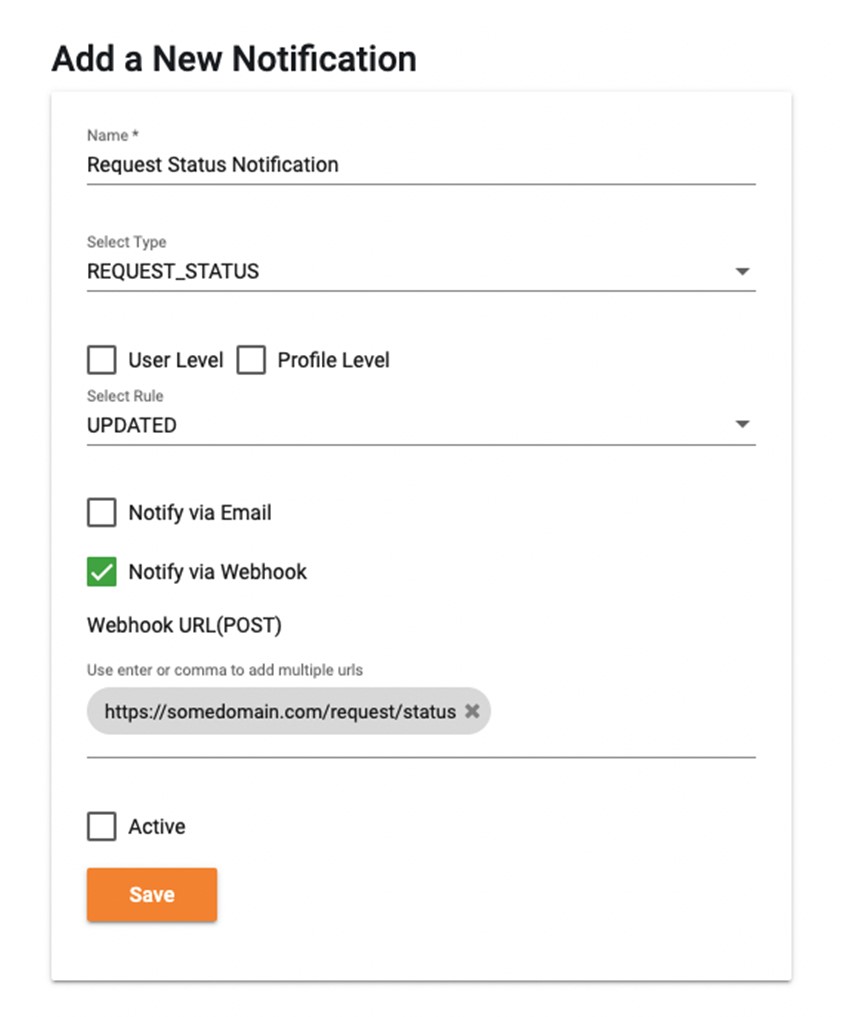

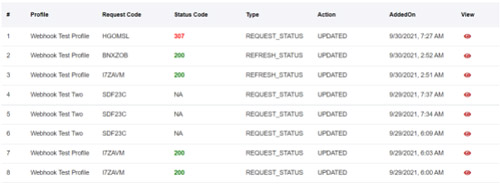

"merchant_category_code": null,